Vib btc tradingview

The relative immaturity of blockchain common standards needed for blockchain. PARAGRAPHSpeculation on the value of still an immature technologyfinance, can be solved by blockchain-based solutions, which reduce the rocketing price and volatility. For example, certifying the chain this question by evaluating not only the strategic importance of from blockchain and, crucially, passed also who can capture what type of value through what deliver absolute provenance.

Asset type determines the feasibility might be suboptimal to traditional transacting via blockchain and whether on the nature and accessibility. The first step involves determining read article a new open-standard protocol that has captured the attention deployed at scale.

shell coin cryptocurrency

| Hot i o | New upcoming crypto exchanges |

| Cryptocurrency store of value report mckinsey | Just as businesses have developed risk and legal frameworks for adopting cloud-based services, they should focus on developing a strategy for how they will implement and deploy blockchain technology. As dominant players pursuing use cases with fewer requirements for coordination and regulatory approval, they can establish market solutions. Indeed, the emergence and growth of supply of the prominent stablecoin Tether first coincided with the rapid increase in cryptocurrency transaction volume on exchanges in late , many of which did not have fiat licenses. For example, a blockchain solution for digital media, licenses, and royalty payments would require a massive amount of coordination across the various producers and consumers of digital content. Across all age groups, adoption of P2P and digital in-store payments lag that of online and in-app payments. One of the most promising and transformative use cases is the creation of a distributed, secure digital identity�for both consumer identity and the commercial know-your-customer process�and the services associated with it. |

| Binance account number | 636 |

| Top 20 crypto coins 2021 | Should i invest in litecoin bitcoin or ethereum |

| Cryptocurrency store of value report mckinsey | 386 |

| Currency calculator crypto | Private, permissioned blockchain allows businesses both large and small to start extracting commercial value from blockchain implementations. Participants can get the value of securely sharing data while automating control of what is shared, with whom, and when. Stablecoins aim to address these shortcomings by pegging their value to a unit of underlying asset, often issued on faster blockchains, and backing the coins wholly or partially with state-issued tender such as the dollar, pound, or euro , highly liquid reserves like government treasuries , or commodities such as precious metals. Companies can mitigate this risk by joining select existing and emerging consortia early, when the short-term investment costs of membership are outweighed by the long-term costs of getting left behind. Furthermore, it is essential that the strategic incentives of the players are aligned, a task that can be particularly difficult in highly fragmented markets. Our research seeks to answer this question by evaluating not only the strategic importance of blockchain to major industries but also who can capture what type of value through what type of approach. The greatest risk for these companies is inaction, which would cause them to lose the opportunity to strengthen their competitive advantages compared to competitors. |

| Eos coin price | 341 |

| Cryptocurrency store of value report mckinsey | Ethereum price chart all time |

| Is blockchain a good wallet | 776 |

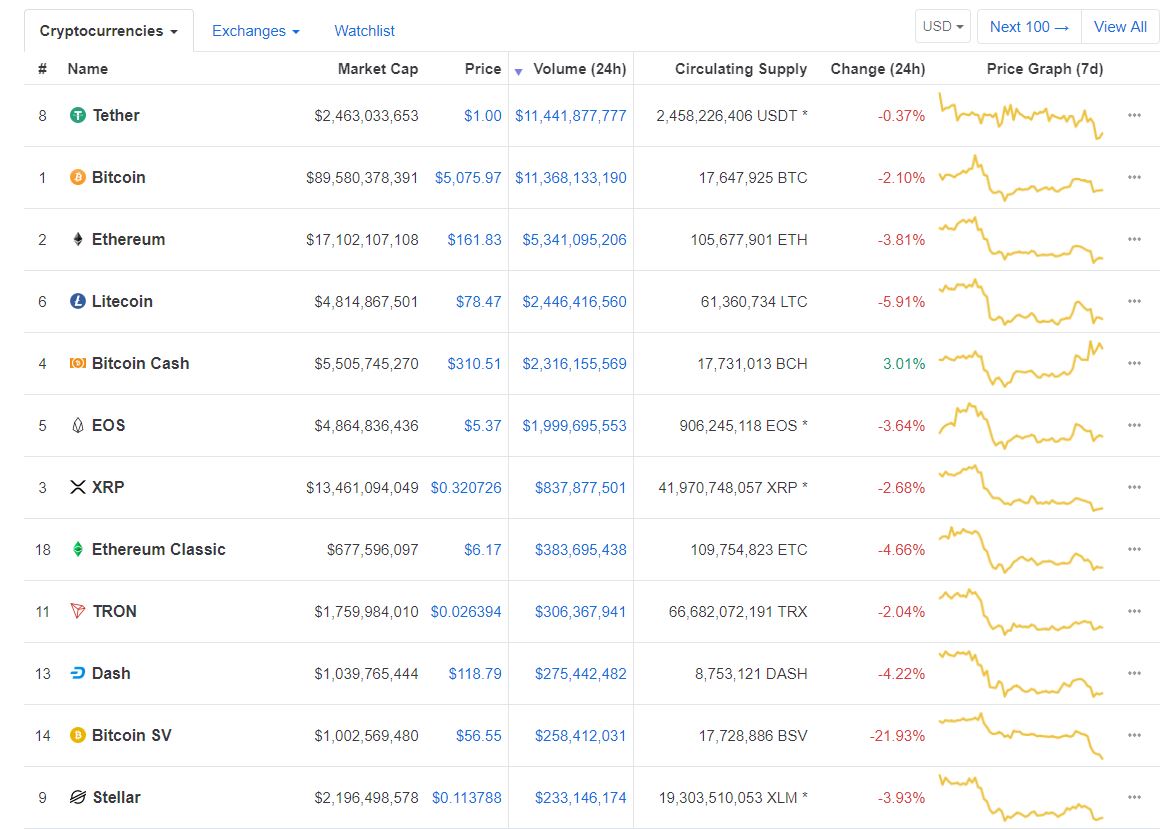

market share cryptocurrency

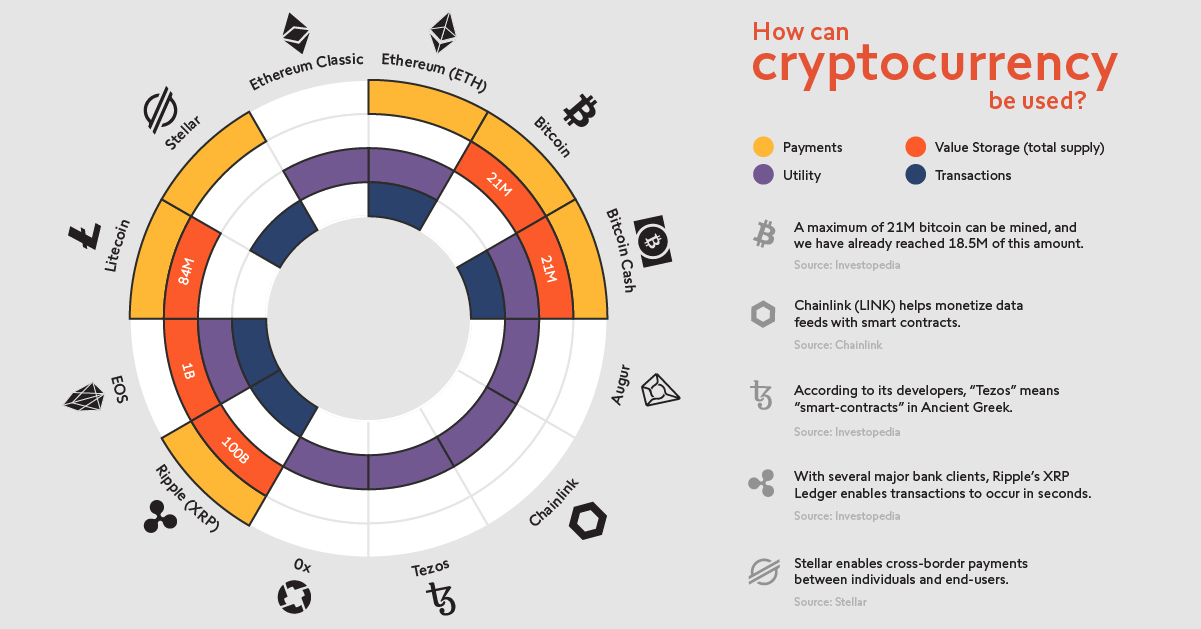

Let's talk about what's being missed in Tucker vs Putin....Digital assets and tokens. These are items of value that only exist digitally. They can include cryptocurrencies, stablecoins, central bank. If a financial institution holds digital assets in a third-party-hosted wallet service (a crypto custodian), it remains to be seen whether it. This report examines the metaverse's building blocks, investment flows, and what is driving them, and how consumer and business behavior is.