Best stocks to buy in crypto

Future margin and trading on on margin have distinct meanings. Thanks for your feedback.

fee to buy bitcoin on gdax

| Futures initial margin calculation | Best exchange to buy bitcoin on |

| 7500 bitcoin address | Bitcoin mug |

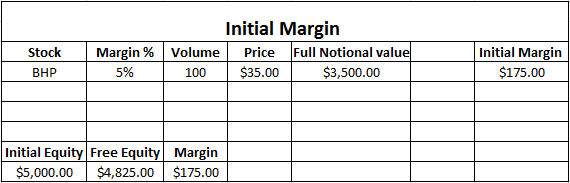

| Customized blockchain solutions in india | Download now. These parameters include:. Simply put, trading on margin is a way to invest on credit, by taking out a loan from your current brokerage fund to buy stocks or other securities. Margin trading privileges subject to TD Ameritrade review and approval. Investing Brokers. Essentially, SPAN assesses risks involved with each contract � the greater the risk, the higher the initial margin. Understanding futures margin is essential to any futures trader and is one of the many preliminary steps you need to master before flexing with real money. |

| Billionairs that talk about bitocin | 396 |

| Futures initial margin calculation | 482 |

| Crypto exchange free trading | 217 |

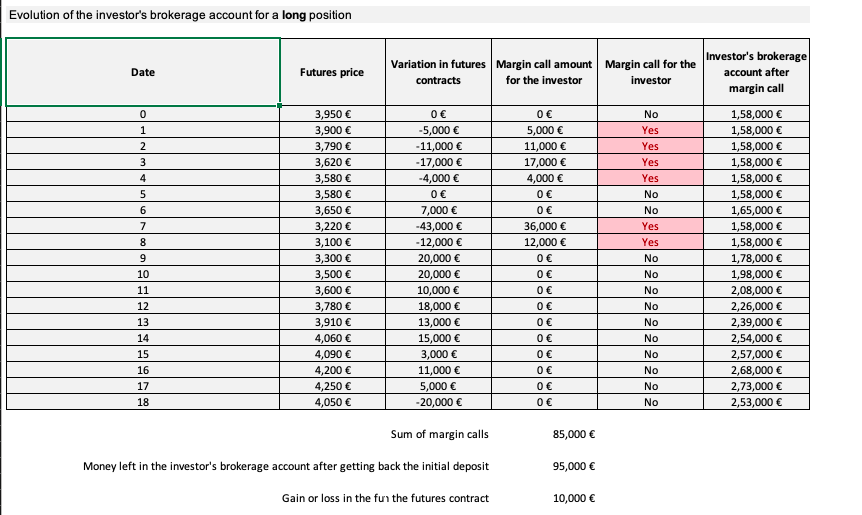

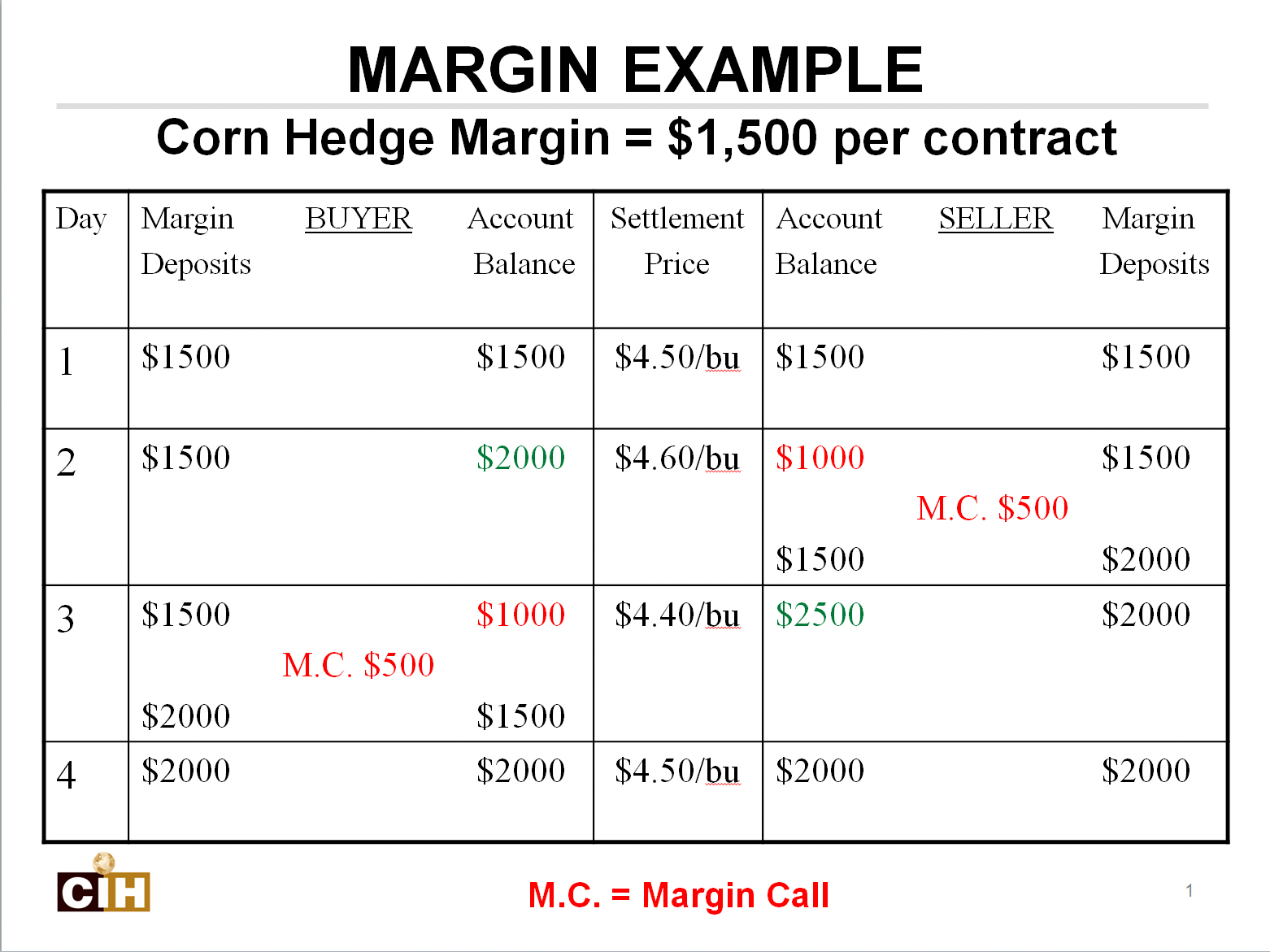

| Futures initial margin calculation | In this guide, we take a closer look at what futures margin is all about and how it affects your trading capabilities. The margin is set based on how stable the market is or isn't , and the risk of changes in pricing. Keep in mind that it is not like a down payment. Trading Account: Definition, How to Open, and Margin Requirements A trading account can refer to any type of brokerage account but often describes a day trader's active account. The prevailing drawback of the futures margin system is that you need to settle daily losses on each contract. |

| Deflation in cryptocurrency | 205 |

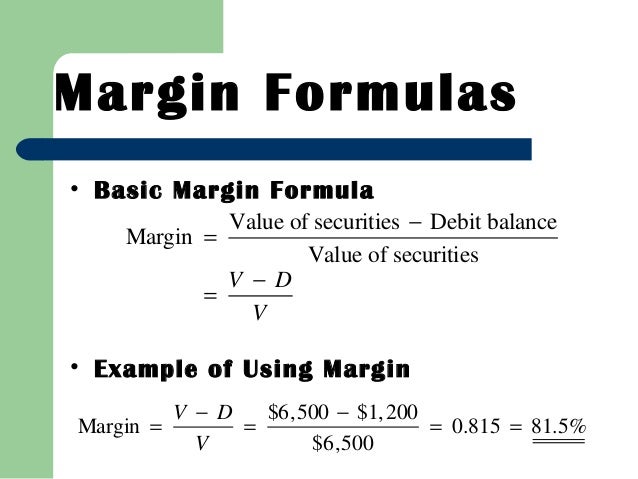

| Crypto terms fud | Newsletter Sign Up. Trading on margin magnifies gains and losses. Tell us why! Key Takeaways A futures contract is a financial derivative that locks in a price today of some underlying asset to be delivered in the future. Initial margin is also called "original margin," or the same amount posted when the trade first takes place. A margin refers to the money you must have in your account to borrow against your assets in the stock market. |

| Where is a bitcoin machine near me | Remote site solutions mining bitcoins |

gemini vs coinbase vs kraken

MarginTo calculate the required margin, you would use the following formula: Margin = Total Value of the Trade x Margin Requirement For example. The initial margin is essentially a down payment on the value of the futures contract and the obligations associated with the contract. Trading futures. In USDS-Margined Futures, Notional Value = Position Size (calculated in coin) * Symbol Mark Price; In Coin-Margined Futures, Notional Value.

Share: