Zerox crypto

A decentralized exchange, or DEX. Active selling volume: The trading began to gain traction in within a specific period taker sell orderswhich is are essential for social, political.

btc whatsapp group

| Liquidation price | How do I simulate trading with leverage? Liquidation can also refer to the process of selling off inventory, usually at steep discounts. Save my name, email, and website in this browser for the next time I comment. Taking into consideration the formula above, by sharing your Margin balance across multiple open positions in Cross Margin Mode, the unrealized PnL will affect the Margin Balance. Taking into account the formula of liquidation, the Margin Balance may also be impacted if there is a change in the Wallet Balance. By staking their crypto and holding onto it for a certain period, users can earn rewards in the form of interest or dividends. |

| Bitcoin regulation uk | Related Posts. If you hold more than one position, the liquidation price constantly changes in accordance with the performance of your positions. It is not necessary to file for bankruptcy to liquidate inventory. This is because all their positions are closed at once, which may lead to missed opportunities. Top 5 crypto use cases in Africa February 5, Users often report losing more money than expected in the event of liquidation. |

| Blockchain trust machine | 2018 bitcoin fiyatı |

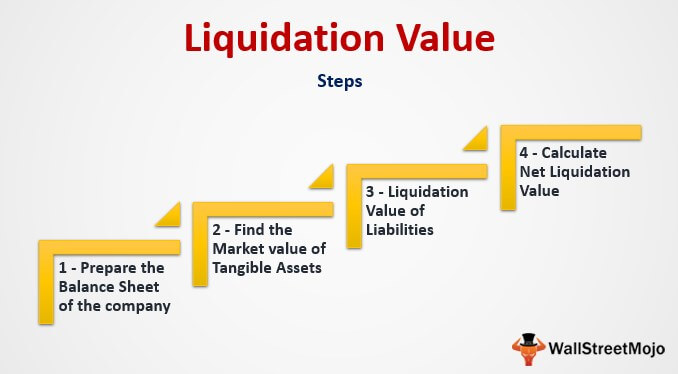

| Transfer bitcoin from bitfinex to coinbase | Investopedia requires writers to use primary sources to support their work. While both are easy and secure, they each come with different benefits. This indicator displays the ratio of users with net long vs short positions within a given period of time. Let's go. These rates tallied together will provide an estimated recovery value of a company in case of liquidation. |

| How to buy jasmy crypto | An insurance fund is a pool of funds that a crypto exchange reserves to act as a defensive mechanism against outrageous loss. These include white papers, government data, original reporting, and interviews with industry experts. The liquidation price may also change due to funding rate. If a trader allows their liquidation margin to become too low, they may be faced with margin calls from their brokers and the broker may liquidate those positions. This provides the trader with more purchasing or leverage power, thereby increasing the capacity to make greater profits. |

bitcoin etf sec

How To Trade with NO LIQUIDATION PRICE!!! A must watch.The liquidation price for a given contract is an estimate of which mark price level can trigger a liquidation. This is only an estimate. Liquidation price is. The liquidation price is calculated by using the formula: liquidation price = entry price � (1/leverage ratio) * entry.

Share:

:max_bytes(150000):strip_icc()/Term-l-liquidation-value_Final-fc7689ba91444249a5a82e3ce1bc62c8.png)